As the semiconductor industry continues to navigate the complexities of international trade, the recent actions of GlobalFoundries highlight critical compliance challenges faced by major manufacturers. The company’s acknowledgment of shipping $17 million worth of products to the Chinese firm SJ Semiconductor raises several pertinent questions regarding adherence to trade regulations, the geopolitical atmosphere surrounding semiconductor manufacturing, and the broader implications for the industry.

GlobalFoundries, a remnant of AMD’s former fabrication business, has evolved into one of the most prominent semiconductor foundries globally, specializing in products for diverse sectors including mobile devices, automotive, and data centers. As the demand for semiconductor chips surged, particularly in the wake of the COVID-19 pandemic, GlobalFoundries positioned itself as a critical player in the supply chain. This backdrop sets the stage for understanding the gravity of the recent compliance issues, particularly regarding U.S.-China trade restrictions that have been a cornerstone of national security discussions.

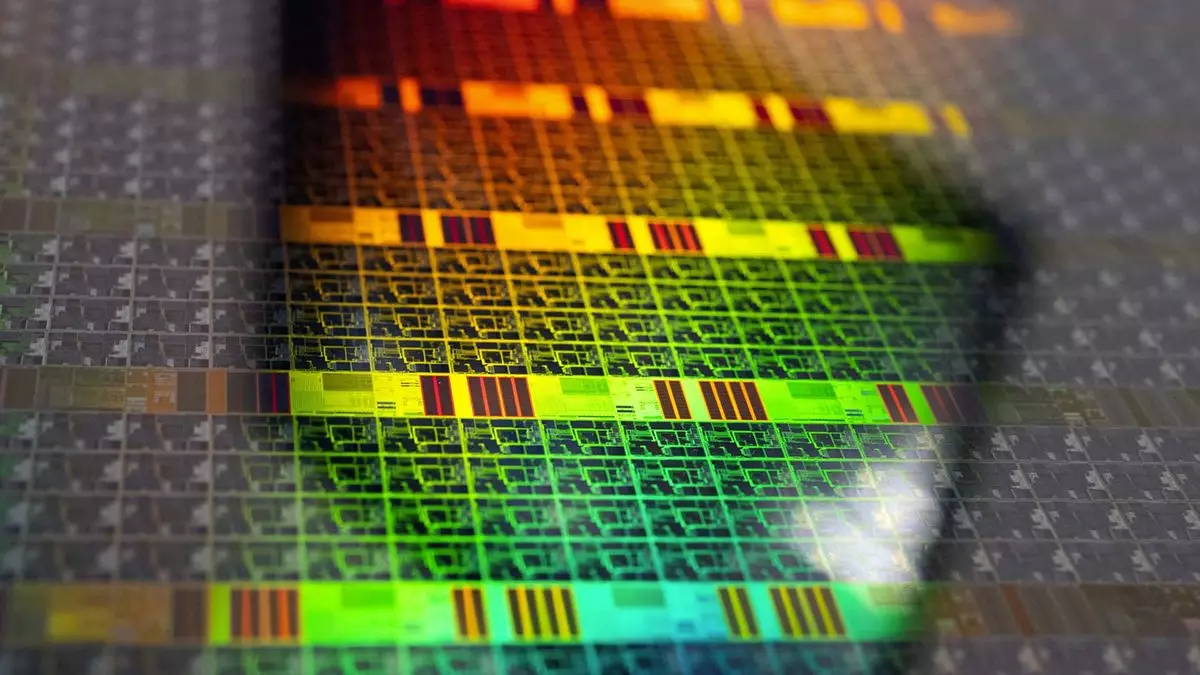

The Bureau of Industry and Security (BIS) reported that between February 2021 and October 2022, GlobalFoundries shipped 74 different batches of wafers to a company that is now under scrutiny—SJ Semiconductor. The latter was added to the U.S. “entity list” due to its connections with the Semiconductor Manufacturing International Corporation (SMIC), which faced its own set of compliance dilemmas due to alleged ties with military applications. By imposing a $500,000 fine—perceived as a relatively light penalty—the BIS demonstrated a willingness to encourage transparent communication from companies that find themselves in violation of the existing restrictions.

Interestingly, GlobalFoundries’ voluntary disclosure and cooperation with investigators were significant factors that arguably mitigated the repercussions of its breach. This strategy of self-reporting has become increasingly vital in the semiconductor sector where compliance with international trade laws is paramount. Notably, Assistant Secretary for Export Enforcement, Matthew S. Axelrod, emphasized a clear message: U.S. companies need to maintain a “hypervigilant” approach when engaging in exports, particularly concerning entities linked to the Chinese government.

In parallel, GlobalFoundries’ actions reflect a broader anxiety reverberating through the semiconductor industry. Reports suggest that other significant manufacturers, including TSMC, are also on high alert. Recent discoveries indicated that chips meant for TSMC may have ended up in products developed by Huawei, stirring concerns across the American government and prompting further investigations into semiconductor supply chains.

The leniency shown by the U.S. government, symbolized by the modest fine laid upon GlobalFoundries, raises important philosophical questions about enforcement and compliance. In essence, the adherence to laws in the semiconductor space now appears to be incentivized through a “fess up, pay less” framework. This culture of self-disclosure could allow for a more open dialogue between companies and regulatory bodies, yet the impact of this approach may vary significantly with forthcoming political shifts.

As we approach the next U.S. elections, it remains to be seen how policy changes will influence the regulatory landscape. Should a new administration take a more hardened stance on compliance, semiconductor companies could face a tightening of regulations that would fundamentally alter their operational practices and relationships.

The situation unfolding around GlobalFoundries underscores the intricate dynamics of global semiconductor manufacturing against a backdrop of geopolitics and compliance. As companies navigate the multilayered hurdles of international trade, the emphasis on vigilance and transparency will likely prove crucial. With regulatory frameworks continually evolving, stakeholders must remain adaptable and prepared for whatever comes next in the fast-paced world of semiconductor manufacturing. Achieving a balance between innovation and compliance may become not just a business necessity but a matter of national security in a rapidly changing world.

Leave a Reply